Debt Relief Services

Say Goodbye to Financial Stress with Emergency Debt Relief

We completely understand that financial challenges can be overwhelming especially when you are burdened with unmanageable debt. If you feel weighed down by creditors bills and endless payments then you must know that you are not alone. Millions of people today globally face every day. But there is hope. Our Debt Relief Services are especially designed to provide you with support guidance and solutions you need to break free from the cycle of debt and reclaim control of your financial life.

Understanding Debt Relief

Debt relief is a range of strategies and solutions that are specially designed to help you reduce or eliminate your debt burden. Some of the most common solutions here include debt consolidation, debt settlement, credit counseling, bankruptcy, and others. You need to know that debt can come in different forms like credit card debt, medical bills, student loans, mortgage loans, and even personal loans. All the debts might require a different approach to achieve relief effectively.

How Are Our Best Debt Relief Services?

- The first step in our credit card debt relief services includes conducting a comprehensive assessment of your financial situation. We include reviewing your income, expenses, debts, and assets. We will help you determine the best course of action.

- Based on the assessment we will develop a customized debt relief solution tailored to your specific requirements and objectives. We offer different solutions like debt consolidation loans, debt settlement negotiations, or enrollment in a debt management program.

- If you’re overwhelmed by unsecured debts like credit card bills or medical expenses we can help you negotiate with your creditors. We will help you reduce the total amount owed and establish manageable repayment terms

- Throughout the debt relief process, we will provide you with ongoing support and guidance we will make it very easy for you to stay on track and make informed financial decisions. Our team of experts is always available to answer all your queries, address concerns, and provide assistance whenever you need it.

Benefits of Using Our Top-rated Debt Relief Services

- One of the best parts about using our debt relief services is the opportunity to reduce your overall debt burden. By negotiating with creditors and developing manageable repayment plans we can help you achieve significant savings. Through our services, we can also help you regain your financial stability.

- Debt can take a major toll on your mental and emotional state. By choosing our debt relief services you can get rid of stress and anxiety linked with overwhelming debt. We will also make it very easy for you to enjoy a better peace of mind.

- Doubt debt relief might initially hurt your credit score but it can ultimately lead to long-term improvements. By addressing outstanding debts and establishing responsible financial habits you can now rebuild your credit with time and achieve A healthier credit profile.

Debt Settlement Services: Negotiating Your Way to Financial Freedom

If you’re struggling to make small payments on your debts, Debt Settlement Strategies may be the solution you’ve been searching for. These services involve negotiating with your creditors to reduce the total amount you owe. By reaching a settlement agreement, you can pay off your debts for less than what you owe.

Debt Settlement Programs are particularly beneficial for individuals with lots of unsecured debt. We include credit card debt. Experienced negotiators can help you save thousands of dollars. We can also help you become debt-free in a shorter period.

FAQs

- What types of debt can be included in debt relief services near me?

Debt relief programs focus on unsecured debts. It means you can expect credit card bills, medical expenses, and personal loans. Some secured debts like mortgage loans and car loans can also be eligible for some types of debt relief.

- What debt relief will impact your credit score?

The debt relief might have a temporary negative impact on your credit score. It includes negotiating with the creditors and restructuring the debt repayment plans. With time, responsible financial management can lead to better improvements in your credit score.

- How much does debt relief cost?

The cost of the debt relief services might depend on the type of program and the complexity of your financial situation. We offer transparent pricing and flexible payment options to accommodate your requirements.

We are your trusted partner for all your debt relief requirements. With our comprehensive services experience team and a commitment to client success, we have what it takes to help you achieve financial freedom and live a life free from the burden of debt. You can connect with us today to schedule a consultation and take the first step towards a debt-free life.

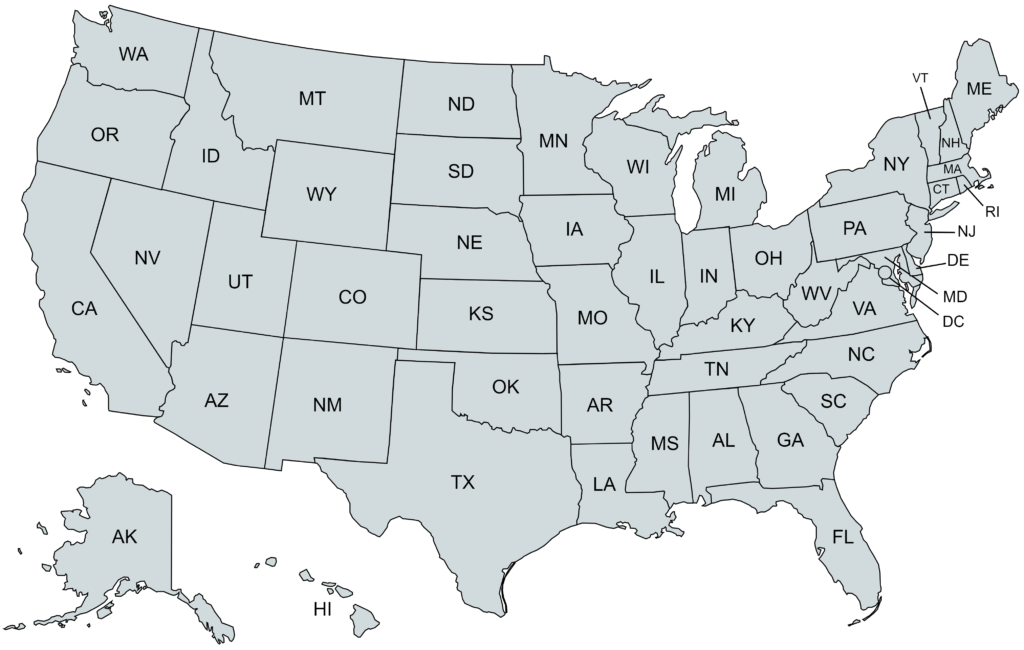

Locations:

FAQ

Debt relief services help individuals struggling with overwhelming debt. They do this by negotiating with creditors to reduce the total amount owed. This process aims to provide financial relief and create a manageable repayment plan

Debt relief services involve assessing your financial situation. They negotiate with creditors for lower payments or reduced interest rates. They consolidate debts into more manageable plans.

People experiencing significant financial hardship or unable to meet their monthly debt obligations may qualify for debt relief services. Eligibility often depends on the severity of the financial situation.

Debt relief services generally cover unsecured debts, such as credit cards, medical bills, and personal loans. Secured debts, such as mortgages or car loans, may have different processes and eligibility criteria.

Debt relief can offer relief. But, there are potential risks. These include negative impacts on credit scores and fees for the services. It’s crucial to research and understand the terms before engaging with any debt relief service.